About Us

We Believe Understanding The Three Q’sTM is Critical to a Successful Transaction.

What makes certain businesses more attractive to buyers and fetch top-of-class offers? It starts with evaluating the “State of Your Business.”

- Sellability Quotient– Not every business is ready to be sold. How sellable is your business…really? There are markers we examine and maximize within your business that drive the success of your transaction.

- Performance Quality– Performance matters. Are you a top performer? Is your business growing? Is your revenue predictable?

- Risk Quantum– Buyers are risk averse. Where is your business on the spectrum of risk?

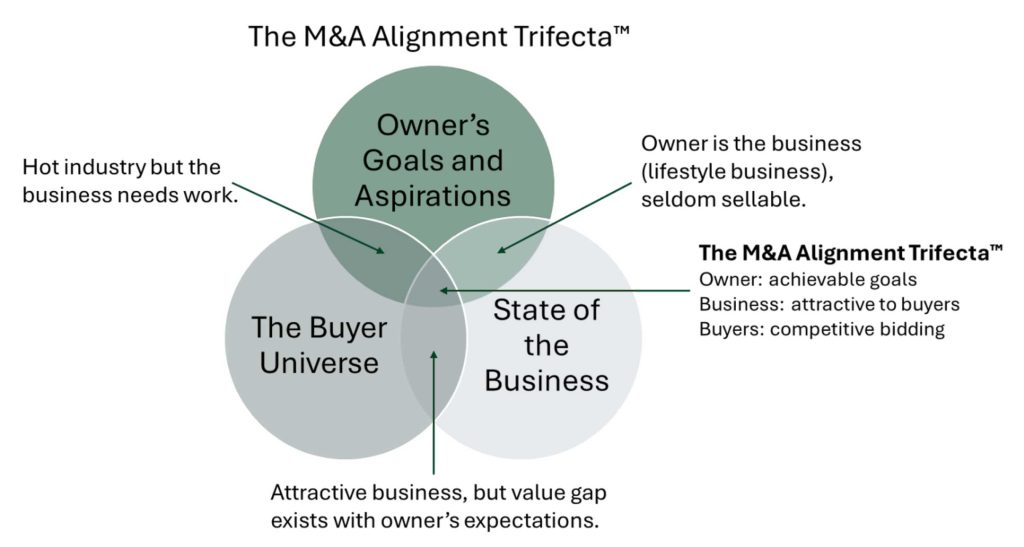

The State of Your Business must also align with your personal goals and aspirations for selling, as well as those of the buyer universe, to support an ideal transaction. This convergence is known as The M&A Alignment TrifectaTM. Best-in-class businesses have achieved the Trifecta.

Our perspective on the M&A community.

Let’s face it: M&A and transaction advisory services are stuck in 20th century paradigms and ways of doing business. Bloated old school professional services with massive overheads mean only one thing: gargantuan fees and a pace that makes sloths seem like gazelles. When you’re ready to sell, there are two axioms that matter the most:

- Speed, elimination of friction, and efficiency defeat the age-old reality that Time Kills Deals; and

- The real value of a deal is the net value in your pocket after paying professional fees, expenses and taxes

We are a connected, state-of-the-art M&A firm, able to seamlessly secure and manage deals efficiently across North America and beyond.

The 9 Principles of JoVoCP (aka, how do you find the right M&A advisor to sell your most valuable asset?)

- Deep transactional experience

- Proven track record of completed transactions

- Exceptional client endorsements

- Continuity and commitment to client care–before, during and after the transaction

- Structured transaction process with proactive vs. reactive marketing

- Custom-built buyer/seller lists and technology leveraging to reach the broadest universe of relevant, interested, and qualified buyers or sellers

- Deal team structure vs. everyone focused 100% on finding new business

- Willingness to be patient if going to market isn’t imminent

- Robust network of M&A-oriented advisors (accounting, legal, investment, etc.)

You only sell your business once! What makes JoVoCP so special?

- We are patient. You may not be ready to sell your business. That’s OK! We will help you establish your vision and direction…advocating for you long before we’re your transaction advisor and assisting you to increase the ultimate value of your business when you are ready.

- We believe in Fit. We know that the right buyer or seller must align with your goals and vision…this extends way beyond the “highest offer.” Lasting, successful transactions have to “fit” on multiple levels: they must be curated, natural, and never forced.

- We get deals done. We know how to get deals across the finish line. Deals can “die” many times between the Letter of Intent and Closing. We won’t give up when the going gets tough–we are creative and sympathetic, and we will find a suitable solution if it exists while fiercely defending your goals and vision.

- Team. We are entrepreneurs and former C-suite executives who are passionate about helping business owners obtain the value-realizing event they’ve earned after decades of sacrifice and dedication.

- Active Presence. We’re there for you: before, during, and after the value-realizing event as your advisor and confidant to provide the support you deserve.

- Process. We deliver maximum value by running a structured, formulated process that allows us to have high confidence in both finding the right buyer/seller and in getting deals across the finish line.

- Transparency. We provide weekly activity updates so you can see the progress toward a transaction through various stages of the process. Throughout the pipeline of your deal you will know exactly what is happening behind the scenes.

- Proactive. We do not sit back and wait for a buyer to come to us. We curate a list of the right kind of buyers and actively market your business, casting the right wide net to maximize value and find the right fit.

Why use an M&A advisor?

- 30% average improvement in deal size vs. not using an M&A advisor

- 400% increase in the number of bona-fide offers vs. not using an M&A advisor

- 95% probability of a deal closing once under Letter of Intent vs. 20% when not using an M&A advisor

- 75% decrease in the time between Letter of Intent and Closing–90 days vs. 360 days when not using an M&A advisor

- Serve as an emotional buffer between buyers and sellers

- Provide an informed view on realistic business valuation

- Lower the stress of transactions by managing the process for you and guiding you through a sale

Why the current M&A environment requires deep experience and a well polished process:

- Increased pre-LOI due diligence

- Transaction multiples are shifting due to market dynamics and industry trends

- Navigating the screening/investment mandate by professional buyers

- Casting a good, wide net with strategic buyers, which requires patience, research and investigative sleuthing

What should every business owner know before going to market?

- What are the current economic and industry headwinds/tailwinds?

- What is the attractiveness of my business to buyers and should I sell now or focus on improvements that will meaningfully increase value and likelihood of selling?

- What is my business worth?

- Enterprise value

- Net after-taxes/fees proceeds

- Value surplus or value gap?

- What is the market for my business? Who are the buyers?

- What does the selling process look like?

- What does an M&A intermediary do?

- Goal #1: create a market and find a buyer or seller

- Goal #2: create an environment for multiple bidders or candidates

- Goal #3: ensure a mutual fit exists

- Goal #4: negotiate to get the best deal and deal structure that is possible

- Goal #5: manage due diligence

- Data room and information requests

- Direct weekly calls between both sides of the transaction

- Coordinate with legal and accounting advisors

- Facilitate management meetings and site visits

- Manage closing process and post-closing true-ups

- We commit an average of 500-600 hours on each transaction, serving seamlessly as a member of your broader team of legal, accounting, and investment advisors.

Your privacy and confidentiality matter! With JoVoCP there won’t be any indication to your employees, competitors, and/or community that your business is for sale:

- No “For Sale” signs

- No postings on general transaction websites (e.g., BizBuySell)

- Discreet packaging of pre-NDA information (no name, broad geography, etc.)

- Hyper-targeted buyers that have been specifically curated (no tire kickers who just want intel about your business)

- No disclosure until a legally binding NDA has been obtained

- Limited access to sensitive information (customers, employees, intellectual property, and competitive/trade secrets) prior to a signed Letter of Intent, and in some cases prior to a signed transaction document.